It is going to focus on the global statistic calculations on the DataFrame

- pd.mean()

- pd.std()

- pd.median()

- pd.sum()

%matplotlib inline

import os

import pandas as pd

import numpy as np

def symbol_to_path(symbol, base_dir="stock/data"):

"""Return CSV file path given ticker symbol."""

return os.path.join(base_dir, "{}.csv".format(str(symbol)))

def get_data(symbols, dates):

"""Read stock data (adjusted close) for given symbols from CSV files."""

df = pd.DataFrame(index=dates)

if 'SPY' not in symbols: # add SPY for reference, if absent

symbols.insert(0, 'SPY')

for symbol in symbols:

# TODO: Read and join data for each symbol

df1 = pd.read_csv(symbol_to_path(symbol),index_col='Date', usecols=['Date','Adj Close'],parse_dates=True,na_values=['nan'])

df1=df1.rename(columns={'Adj Close':symbol})

df = df.join(df1)

if symbol=='SPY':

df=df.dropna()

return df

def test_run1():

# Define a date range

dates = pd.date_range('2010-01-01', '2010-01-10')

# Choose stock symbols to read

symbols = ['GOOG', 'IBM', 'AAPL']

# Get stock data

df = get_data(symbols, dates)

print df

print "the mean value is:n%s" % df.mean()

print "the medim value is:n %s" % df.median()

print "the deviation value is:n %s n and sum is:n %s" % (df.std(), df.sum())

return

test_run()

then, we come to the output:

SPY GOOG IBM AAPL

2010-01-04 98.793254 313.062468 112.285875 27.847252

2010-01-05 99.054769 311.683844 110.929466 27.895396

2010-01-06 99.124509 303.826685 110.208865 27.451683

2010-01-07 99.542943 296.753749 109.827375 27.400936

2010-01-08 99.874198 300.709808 110.929466 27.583106

the mean value is:

SPY 99.277935

GOOG 305.207311

IBM 110.836209

AAPL 27.635675

dtype: float64

the medim value is:

SPY 99.124509

GOOG 303.826685

IBM 110.929466

AAPL 27.583106

dtype: float64

the deviation value is:

SPY 0.428374

GOOG 7.022203

IBM 0.939446

AAPL 0.225798

dtype: float64

and sum is:

SPY 496.389673

GOOG 1526.036554

IBM 554.181047

AAPL 138.178373

dtype: float64

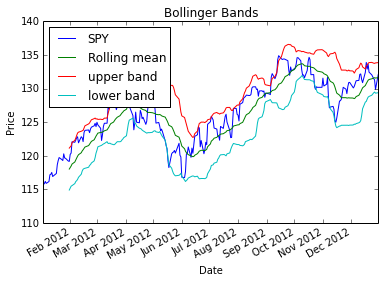

rolling statistics

choose a time sequence like 20 days, then we calculate its mean and deviation;

Next, we step one day forward and calcuate the mean and deviation of the new 20

days again.

-

Series.rolling(window=20).mean()

Get the mean value of the past 20 days of the price.

-

Series.rolling(window=20).std()

Get the standard deviation of the past 20 days of the price.

"""Bollinger Bands."""

import matplotlib.pyplot as plt

def plot_data(df, title="Stock prices"):

"""Plot stock prices with a custom title and meaningful axis labels."""

ax = df.plot(title=title, fontsize=12)

ax.set_xlabel("Date")

ax.set_ylabel("Price")

plt.show()

def get_rolling_mean(values, window):

"""Return rolling mean of given values, using specified window size."""

return values.rolling( window=window).mean()

def get_rolling_std(values, window):

"""Return rolling standard deviation of given values, using specified window size."""

# TODO: Compute and return rolling standard deviation

return values.rolling(window).std()

def get_bollinger_bands(rm, rstd):

"""Return upper and lower Bollinger Bands."""

# TODO: Compute upper_band and lower_band

upper_band = rm + 2 * rstd

lower_band = rm - 2 * rstd

return upper_band, lower_band

def test_run2():

# Read data

dates = pd.date_range('2012-01-01', '2012-12-31')

symbols = ['SPY']

df = get_data(symbols, dates)

# Compute Bollinger Bands

# 1. Compute rolling mean

rm_SPY = get_rolling_mean(df['SPY'], window=20)

# 2. Compute rolling standard deviation

rstd_SPY = get_rolling_std(df['SPY'], window=20)

# 3. Compute upper and lower bands

upper_band, lower_band = get_bollinger_bands(rm_SPY, rstd_SPY)

# Plot raw SPY values, rolling mean and Bollinger Bands

ax = df['SPY'].plot(title="Bollinger Bands", label='SPY')

rm_SPY.plot(label='Rolling mean', ax=ax)

upper_band.plot(label='upper band', ax=ax)

lower_band.plot(label='lower band', ax=ax)

# Add axis labels and legend

ax.set_xlabel("Date")

ax.set_ylabel("Price")

ax.legend(loc='upper left')

plt.show()

test_run2()

近期评论