我的2019 financial accounting学习计划。

MATERIAL: Financial Accounting: Introduction level by UPenn, Coursera, Professor Brian Bouche

Charpter 1 part 2

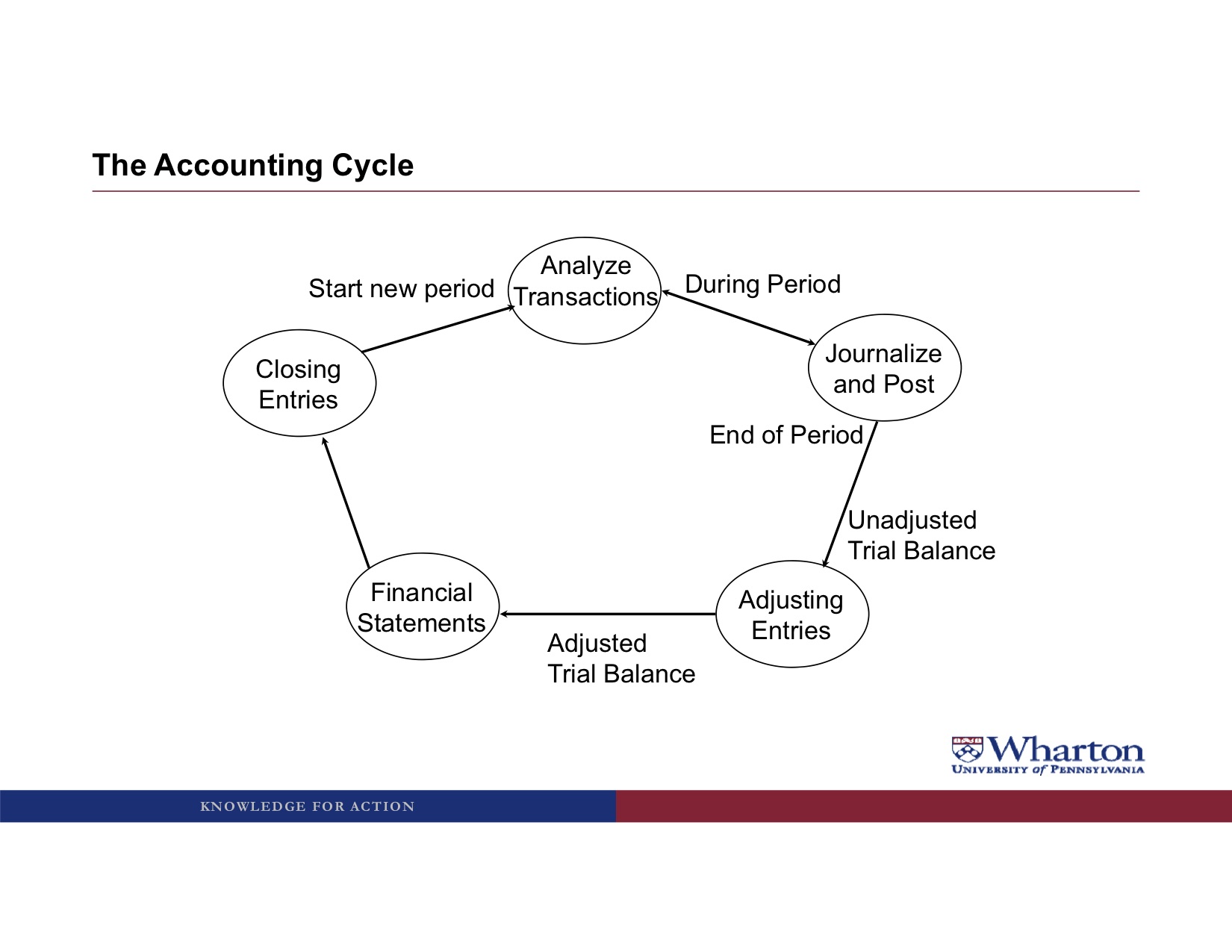

The accounting cycle

Case:

• (1) On April 1, 2012, Girard decided to invest $200,000 and Park put up $50,000 to purchase a total of 25,000 shares in the new company. The par value of the shares was $1.00

Dr. Cash (+A) 250,000

Cr. Common Stock (+SE) 25,000

Cr. Additional Paid-in-capital (+SE) 225,000

• (2) Lacking the funds for her initial investment, Park borrowed the $50,000 from the Imperial Bank of Philadelphia on April 1, using her parent’s house as collateral

Park’s loan of $50,000 not recorded by Relic Spotter

because it is a loan to Park personally, not to the business

entity concept: the only thing that should go in a company’s books are transactions for the company, not transactions for the employees.

• (3) On April 2, Park hired a lawyer to have the business incorporated. Because this was a fairly simple organization, the legal fees were only $3,900

Dr. Legal Fee Expense (+E, -SE) 3,900

Cr. Cash (-A) 3,900

*increase expanse, reduce shareholder equity;

• (5) Park felt that some renovation work would extend the life of the building to 25 years (with an expected salvage value of $10,000). She ordered the renovation work, costing $33,000, to begin immediately. The work was completed on May 25, at which time she paid in cash the amount owed for the renovations

Dr. Building (+A) 33,000

Cr. Cash (-A)33,000 33,000

ignore the stuff about salvage value and 25 years. Instead, we’re gonna focus on the transaction that happened on May 25th, which is when Park paid the cash.

We only use the inventory account for goods that we buy with the intention of selling as quickly as possible at a markup. We don’t call the metal detectors inventory because we intend to keep them for two years and use them over and over and over and over again to generate rental revenues

One of the trickier things to pick up in accounting is, when you spend money, do you recognize an asset or do you recognize an expense? In this case, we did an asset, because we’re going to get three years of future benefits from buying the software.

• (9) On June 30, Park signed a contract with a local advertising agency to provide various forms of advertising for a period of one year. She paid $8,000 upfront for advertising through June 30, 2013

Dr. Prepaid Advertising (+A) 8,000

Cr. Cash (-A) 8,000

Well, we’re getting a year’s worth of advertising without having to pay any additional cash, that’s an asset. So we’re going to create an asset called prepaid advertising

• (10) On June 30, Park needed cash to make a payment on the Imperial Bank loan that funded her purchase of Relic Spotter stock. She borrowed $5,000 from Relic Spotter at 10% interest, with the principal and interest due in a lump sum on June 30, 2013

Dr. Notes Receivable (+A) 5,000

Cr. Cash (-A) 5,000

We credit cash for 5,000. So, what is Relic Spotter getting for this cash? What’s the debit? Well, essentially they’re making a loan. That loan is going to be an asset because they’re entitled to receive 5,000 of cash back from Rebecca Park at some point in the future.

Note that we call it notes receivable. And not accounts receivable. Accounts receivable is only used for customers, when customers owe us money.

• (12) On June 30, Girard called from St. Tropez to check in on the business. Upon hearing that Relic Spotter only had $47,000 of cash left in the bank, Girard became concerned about his investment. Thinking fast, Park stated that she was so confident of Relic Spotter’s prospects that she was declaring a $0.10 per share dividend, to be paid on August 31 ($2,500). This dividend seemed to reassure Girard

Dr. Retained Earnings (-SE) 2,500

Cr. Dividends Payable (+L) 2,500

By convention, when a company declares a dividend it takes it out of retained earnings at that point, even if the cash is going to be paid later. And at that point, the owners become creditors because the company is holding their cash until the dividend checks are sent.

To make sure that the balance sheet equation always stays in balance, we need at least one account that can be either a debit or credit balance.Imagine if we had more liabilities then assets. The only way we could get the balance sheet equation to balance would be with negative stockholders’ equity. And so we make an exception for retained earnings and allow it to have either a debit or credit balance because it’s the one account that makes sure that the balance sheet equation always stays in balance.

3M case study

take care of part II, here’s the big thing management discussion analysis. This is where management tries to explain to the users of the financial statements, what happened during the year. So all the numbers that changed, went up, went down or didn’t change. Tries to provide some kind of explanation so that users can understand the financial statements.

look at the financial statements and the footnotes first. Come up with my own theories for what happened. And then come and see what management’s saying about it. Just as a reality check of whether I can believe what they’re saying.

the financial statements are probably not going to have all the information we need. We’re going to have to dive into these footnotes to really learn what we need to learn about the company. And we’re going to be doing a lot as we go through the course, is looking at the details of the footnotes. because that’s where all the action is.

近期评论